Retiring from the workforce can be an exciting time, and for many people, it’s an opportunity to explore new avenues for income and fulfillment. One such avenue is becoming a business owner.

For most people interested in buying a business, the issue of how to pay for the business or come up with a down payment for a business loan is a challenge.

According to Guidant’s 2022 Small Business Trends report, local banks decline 80% of aspiring business owners from loans to buy a business.

If you’re considering buying a business in retirement, you may be wondering if it’s possible to use your retirement funds to do so. The answer is yes, but it’s important to understand the rules and regulations that govern the use of retirement funds before making a decision.

Don’t worry, there are other ways to get funding, let’s take a look at using your 401(k) to help.

Why should I use my 401(k) to buy a business?

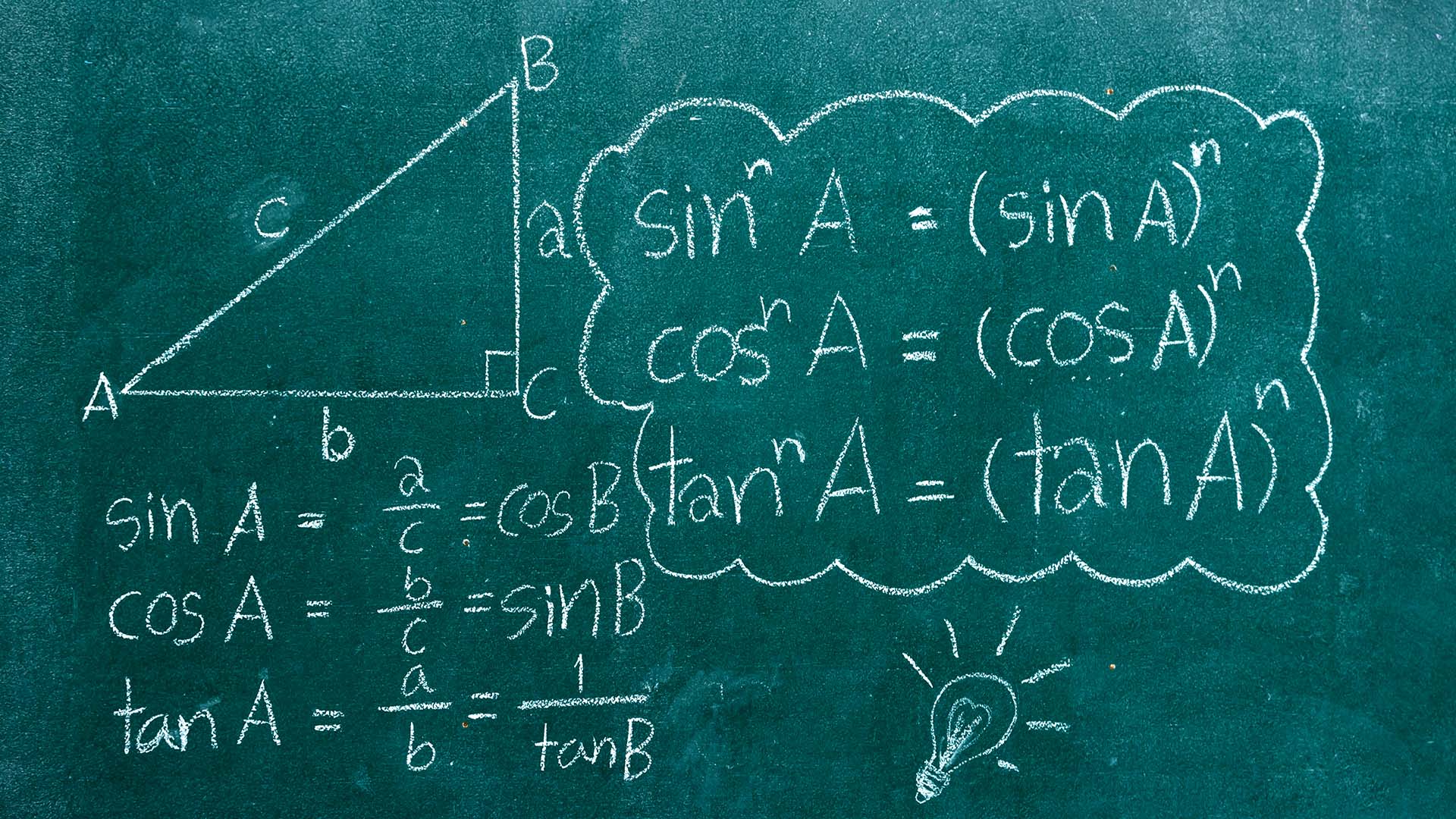

The IRS allows individuals to use their retirement funds, such as a 401(k) or IRA, to start, buy, or access funds to grow a business without incurring tax penalties. This is known as a “rollover for business startups” (ROBS) transaction. However, there are some rules and restrictions that you’ll need to be aware of before using this strategy.

The first thing to know is that you have a rollable retirement fund. Most ROBS providers also recommend you have at least $50,000 in the fund you want to use. If you have less than that, costs and fees may make it too expensive to use a ROBS.

Expert Tip – This is not a loan — ROBS gives you access to your own money so you can buy a business without going into debt.

Here are some other things to consider when using your 401(k)

- No Interest, No Collateral, No Credit Score – 401(k) business financing is a great tool if you don’t want to get a loan, don’t qualify for a loan, or don’t have cash on hand to purchase a business.

The major differences from a bank loan are that your credit score, past experience, or lack of down-payment cash play no role in using your 401(k). - You can still grow your 401(k) – ROBS is also a tool for continuing to save for retirement. When you use a ROBS you are taking money out of your retirement accounts, it also means you are adding money back in.

When you work in your business and pay yourself a salary, you can also contribute a percentage of that salary into a 401(k), just like when you worked for someone else. Your retirement assets will continue to grow as you build your business. - Fully Legal and IRS Compliant – Let’s face it, no one wants to mess with the IRS. Since 1974, the Internal Revenue Code, makes it legal to tap into your eligible retirement accounts to buy a business without an early withdrawal fee (if you’re younger than 59 and a half) or a tax penalty.

How does a ROBS work?

401(k) business purchase financing (ROBS) allows you to access your retirement account and utilize that money to buy a business or franchise. To use your money without triggering an early withdrawal fee or tax penalty, a ROBS structure must first be put in place.

The structure has multiple components, each of which must meet specific requirements to stay compliant with the IRS. Here are the general steps:

- Create a New C Corporation – A new business is established as a C corporation. It’s also possible to convert an existing business, such as an S corp, to a C corp. ROBS rely on a C corporation’s ability to have purchasable stock, so this is required.

- Create a New 401(k) plan for the C Corp – After creating your C corp, you’ll need to set up a retirement plan for the business you buy. Most people choose a standard 401(k), though you have other options.

- Perform a rollover of existing funds – The money in your existing retirement account is rolled into the new 401(k)

- Company plan buys stock in the new C Corp – The company’s retirement plan now has your retirement dollars from the rollover, the plan purchases stock in the C Corp.

- Buy a business – The C Corp now has funds that can be used to buy a business, start a new company, or use it as a down payment for an SBA loan.

Expert Tip – Roth funds are not eligible for ROBS. An experienced ROBS provider can help you determine if your retirement fund qualifies.

Final thoughts on 401k funding

We are not lawyers nor are we financial advisers, but we are interested in helping you understand how to buy a business and use every tool available to get that done.

If you are interested in learning more about using retirement savings to buy a business you may want to visit the Guidant Financial website. They have a bunch of information on using your 401(k) to buy a business.

The bottom line

I know, it sounds scary to use your retirement to buy a business. That money is supposed to be used when you’re old and cranky and yelling at kids to get off your lawn.

Think of it this way, does investing your 401(k) in the stock market make you feel warm and safe at night? At least with a ROBS, you are controlling your own future. A ROBS is not for everyone, but it is a very useful tool to buy a business.

Now go out there and show the future who is the boss!